Lawyers

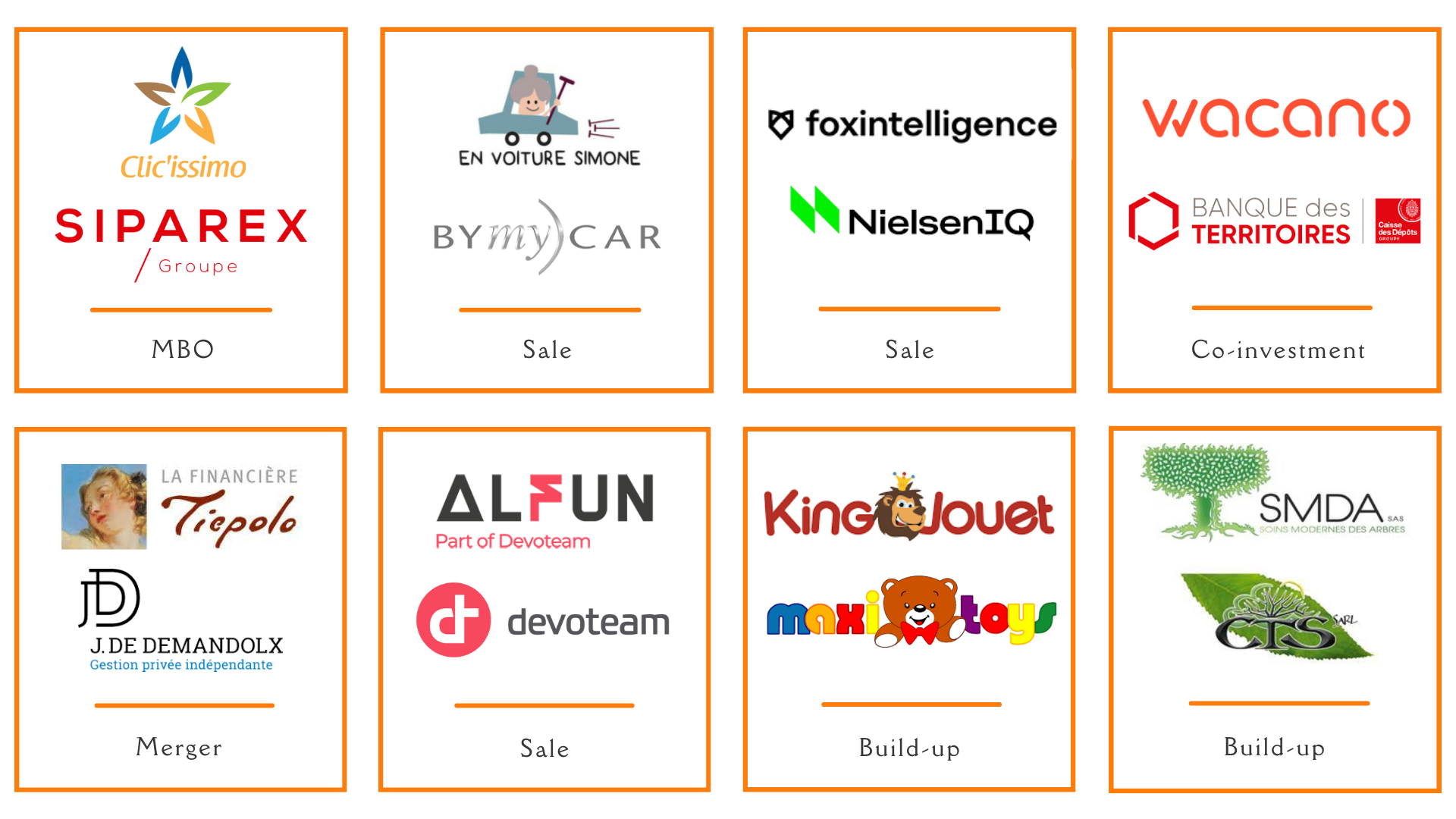

The "Mergers & Acquisitions - Corporate law" department benefits from recognized expertise in many sectors of activity : industry, services, energy, IT, health, ITC, leisure, real estate, medico-social, media, financial management, sustainable development, internet, renewable energy, aeronautics, tourism, sports, agribusiness, transport, banking, training, start-ups, events, education, etc.

It is involved in mergers and acquisitions during external growth acquisitions, private equity operations and in the context of LBOs :

- negotiations and drafting documents

- acquisition audits

- relations with the stock exchange and competition authorities

- shareholders’ agreements

- optimization of acquisition scenarios

- bank financing

- continuity and transfer plans

- takeover of companies in difficulty.

It is involved in all listed and unlisted company operations, in particular in the event of :

- regular legal monitoring for groups and companies

- Fundraising

- equity capital markets (capital increases and reductions, issues of securities, mergers, demergers, etc.)

- restructuring

- stock market regulation and relations with the AMF (IPO, public offers, reference documents, etc.),

- Commercial contracts

- international expansion

- transmission,

- preventive and collective procedures.

In the rankings of the best law firms involved in mergers and acquisitions produced by Décideurs Stratégie Finance Droit magazine, the firm’s "Company Law - Mergers & Acquisitions" department has been in pole position in the rankings of key players for deals up to 75 million euros every year since 2011.

The team works in French, English, and Italian.

Rankings of the department

- CHAMBERS FRANCE 2024

- Corporate/M&A : Mid-Market - Band 3

- General Business Law - Spotlight

- LEGAL 500 EMEA 2024

- in Tier 3 in Private equity : venture and growth capital,

- in Tier 5 in Mergers & Acquisitions.

- PALMARES DU DROIT 2024

- Mergers & Acquisitions <50M€ : Silver Trophy

- PALMARES LE POINT 2024

- Corporate law : ⭐⭐⭐⭐⭐

- Mergers & Acquisitions : ⭐⭐⭐⭐⭐

- DECIDEURS 2023

- LBO - lower-Mid et Small-Cap : Unbeatable

- M&A - Transactions up to €75M : Unbeatable

- Growth capital : Excellent

- Venture Capital : Excellent

- Acquisition financing : Highly regarded

- Advice to management teams : Highly regarded